Protectorate Protocol

Litepaper

By Protecc Labs

The Definitive Liquidity Layer for NFTfi

What is Protectorate?

Protectorate is an innovative protocol designed to generate deep, sustainable liquidity for both NFTs and NFT financialization (NFTfi) protocols that have been developed to address the issues surrounding NFT liquidity. Functioning as a yield aggregation platform or a liquidity router, Protectorate aims to deliver the highest yield possible by deploying the assets deposited into a variety of strategies across NFTfi protocols.

The platform enables seamless liquidity provision for any NFT collection through a diverse range of partner NFTfi protocols, eliminating the cost, risk, and complexity associated with liquidity mining methods. Positioned as a "layer above" marketplaces, money markets, NFT AMMs, and other NFTfi protocols, Protectorate streamlines the provisioning process.

As it continues to develop, Protectorate strives to be truly cross-chain by deploying its systems wherever opportunities arise to enhance NFT financial infrastructure. Regardless of the network, Protectorate Protocol aspires to become the go-to hub for NFT liquidity.

NFT Liquidity Today

The current state of liquidity for NFTs is characterized by extremely fragmented, unpredictable, and unsustainable sources. Developers of new projects often face substantial costs as they pursue temporary liquidity solutions through unsustainable hype tactics, which resembled the hyperinflationary token incentive schemes used by early DeFi protocols to attract users, who, unsurprisingly, were not retained.

Relying on whales to provide liquidity leads to a continuous state of uncertainty and gatekeeping. Insufficient liquidity consequently results in poor pricing and volatility, negatively affecting collections and collectors who seek deep liquidity for their holdings. Additionally, it impacts marketplaces striving to provide the best possible pricing and liquidity.

High-Level Protocol Overview

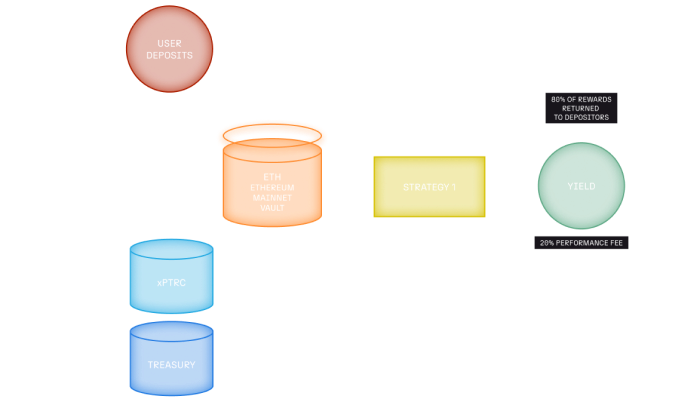

Protectorate enables users to provide liquidity, and the platform determines where that liquidity is deployed with the goal of allocating it to the highest-yielding strategies across NFTfi.

Envoys (liquidity providers) deposit single-sided assets into individual Capsules (NFTs, ETH, Stablecoin, etc).

Elders (xPRTC stakers) will earn revenue from the yield generated through Protectorates strategic deployments of assets provided to the protocol.

PRTC (Native token) will initially be used for revenue sharing, and eventually governance. In the future, Protectorate may utilize its own liquidity to be provided on-demand for collections it believes may generate significant yield.

The protocol captures value by providing liquidity across the NFTfi space. Over time, Protectorate will build a strong reserve of various assets that can be safely deployed to continuously generate yield, which will be shared among liquidity providers, the protocol, and xPRTC stakers.

Protectorate offers unique composability opportunities for both new and existing collections and DAOs, allowing for more strategic liquidity provision across the entire NFTfi stack.

Simplifying NFT Liquidity Provision at Scale

Determining which collection to provide liquidity for, and on which platform can be an overwhelming task for the average collector. Most users in the NFT space are not entirely familiar with the intricacies of financializing NFTs, let alone understanding the backend operations, such as the exact strategies and the infrastructure these strategies interact with. Protectorate aims to simplify the experience of providing liquidity, making it easy and seamless for users of all types (retail or institutional) to access the highest possible yield in the NFTfi space.

Deepening On-Chain Liquidity for NFTs

NFTs have long been known as an illiquid asset class. Before the advent of NFT AMM’s, most NFT liquidity was found through offers placed on off-chain orderbook marketplaces. With the emergence of various NFT financialization protocols, Protectorate aims to be a dependable source of on-chain liquidity for these protocols, incentivizing capital utilization around NFTs in novel ways. This generates appealing yields for NFT collectors and traders, enhancing the NFTfi experience. Users who interact with protocols that receive liquidity from Protectorate will benefit from significantly improved liquidity, offering deep ETH liquidity and, eventually, NFT inventory.

Target Users

Any NFT trader, collector, DAO, or institution can potentially benefit from using Protectorate. Today, every kind of participant in the NFT space is providing liquidity to a collection or protocol in some capacity, whether through pools on NFT AMM’s, placing collection offers on secondary marketplaces and aggregators, or activating capital (borrowing and lending) on NFT money markets. Protectorate aims to simplify and optimize the process of providing liquidity, making it attractive for a wide range of users within the NFT ecosystem.

Visualization- Protectorate Protocol v0.1

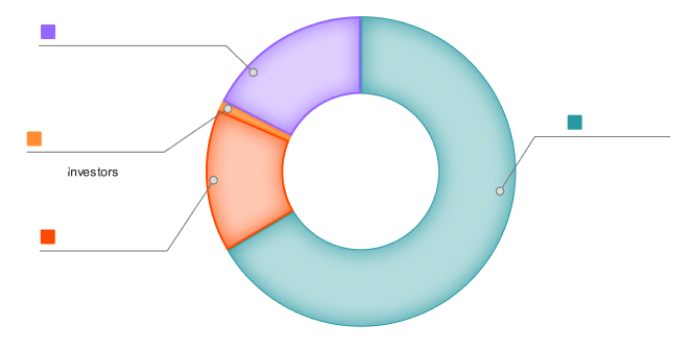

Protectorate and PRTC- Tokenomics & Distribution

Soon after the public launch of the Protectorate Protocol, Protectorate will begin the distribution of PRTC, the native token of Protectorate, during its ‘Event Horizon’. The PRTC token will have a number of use cases. The total supply of PRTC will be hard-capped at 100,000,000. This token distribution event will set the foundation for future incentives, revenue sharing, and governance within the Protectorate ecosystem.

- Advisors - 1% (1,000,000)

- Advisors of Protecc Labs will receive a pro-rata token share in Protectorate The allocation includes a 6-month cliff, followed by monthly vesting over a period of 36 months. This allocation structure ensures that advisors have a vested interest in the long-term success of the project and continue to provide valuable guidance and support during its growth.

- Investors - 15% (15,000,000)

- Investors in Protecc Labs, will receive a pro-rata token share in Protectorate, with no cliff, and monthly vesting over a period of 36 months.

- Protecc Labs - 17.5% (17,500,000)

- The current primary contributors to the Protectorate Protocol who will maintain the protocol from developmental, community, business development and marketing standpoints. Protecc Labs will have a cliff of 6 months, followed by monthly vesting over a period of 36 months.

- Treasury - 66.5% (66,500,000)

- The treasury is governed by the Protectorate DAO, with assistance from the Elder Council, to prevent governance attacks. Treasury assets may be used for bug bounties, audits and grants to build in the Protectorate ecosystem, liquidity mining, and paying contributors. At some time after the launch of Protectorate, beginning with the Event Horizon, the treasury may allocate PRTC tokens to bonding programs where users will be able to bond NFTs, ETH, or Stablecoins in exchange for PRTC. These acquired assets will serve as Protectorate's reserve assets. The Elder Council may choose to open bonding for PRTC at any time for any assets, should it want to grow its liquidity. Upon launch, 25% of the treasury allocation will be unlocked, allowing Protectorate to execute its operations seamlessly with the necessary funding. The remaining 75% will vest in parallel with investors, advisors, and team allocation with no cliff, on a monthly basis over 36 months. This approach ensures proper governance and a robust financial ecosystem for the continued growth and development of the platform.

The Elder Council & Protectorate DAO

The Elder Council, at its inception, will consist of 5 appointed members who will act as a preventative measure against any malicious protocol governance attacks. Over time, the Protectorate Protocol will gradually transition its governance to the Protectorate DAO, meaning all protocol-related activity will need approval from the DAO. The initially appointed members of the Elder Council will be credible individuals with a vested interest in the long-term health and success of the Protectorate Protocol and the Protectorate DAO. One member will represent Protecc Labs while the remaining four members will consist of investors, and advisors.

The purpose of the Elder Council is to stabilize the governance of the protocol in its infancy and safeguard its long-term interests. This may be achieved by advising against proposals that could harm protocol operations through the treasury, its strategies, and more; proposing amendments to such proposals; or vetoing malicious proposals altogether. The Elder Council serves as a checks and balances system, to prevent any individual with vested interest in the protocol from executing any malicious behavior that may impact the overall health and longevity of Protectorate Protocol & the Protectorate DAO.

As the Protectorate DAO matures, responsibility for governance is expected to transfer from the Elder Council to the Protectorate DAO.

Regarding the role of PRTC, initially, PRTC can be staked for a revenue share from the Protectorate Protocol as xPRTC. Once the Protectorate DAO is formed, staked PRTC (xPRTC) will be granted governance power at a rate of 1:1, meaning 1 xPRTC represents 1 vote. This approach ensures that token holders can actively participate in shaping the platform's future while benefiting from its success.

Tokenomics- Distribution

Protectorate will distribute protocol profit amongst its depositors, xPRTC holders, and the Protectorate Treasury, paid in ETH or stablecoins. The profit that the protocol accrues allows Protectorate to grow its runway in a sustainable manner, and re-invest back into the protocol without having to dip into treasury funds. The distribution of this profit is as follows:

- Protectorate Depositors - 80%

- Protectorate Protocol - 20%*

- xPRTC holders - 10%

- Protocol treasury - 10%

- * The 20% Protocol fee is split evenly, with 10% of value to PRTC Holders and 10% for the Protocol Treasury

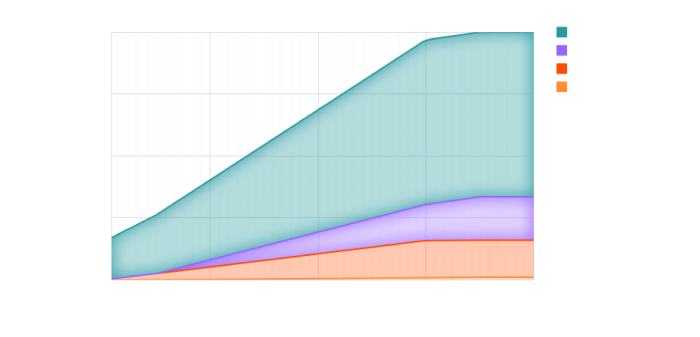

Emissions Schedule

Conclusion

The goal of Protectorate Protocol is to bring an element of cohesion across the NFTfi landscape. In the early stages of the NFT boom, trading became fragmented as various marketplaces competed for attention. This fragmentation created a vicious cycle for NFTs, ultimately leading to the birth of the "illiquid JPEG" meme.

As demand for NFT liquidity is skyrocketing, mercenary liquidity can severely damage collections as farmers lose interest and move on to the next best opportunity. Protectorate aims to act as a reliable source of liquidity for NFTs across various verticals, starting with its money market partners and eventually expanding its horizons.

By offering a stable and trustworthy platform for NFT liquidity, Protectorate Protocol seeks to address the issue of fragmentation and contribute positively to the NFT ecosystem, making it more accessible, sustainable, and valuable for all participants.